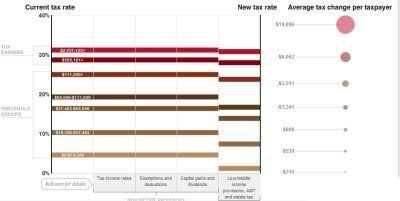

I have to say I'm fairly happy with the compromise the president worked out with Congressional Republicans. I didn't want a full continuation of the tax cuts because it would cost $3.9 trillion over the next ten years. The president's version, where all but the highest earners would keep the cuts, wasn't a whole lot better -- $3 trillion.

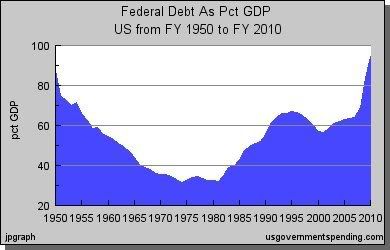

Instead, we'll increase the deficit by $900 billion in two years, and revisit the issue when the economy's stronger. I just hope we can make some progress on our national debut before the next decade ends. As it is now, we're fast approaching 100% of our GDP -- relative debt levels haven't been this high since World War II.

Republicans talk about smaller government and cutting government waste. These are fine ideas, but most federal spending is mandated. There's no cutting Social Security or Medicare, and defense spending is tricky while we're still obligated in the Middle East.

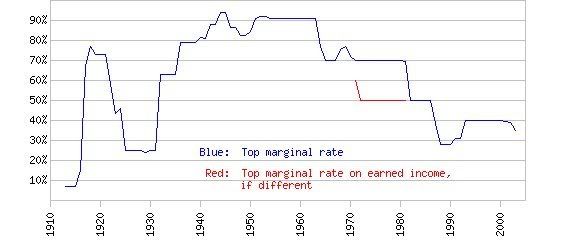

So that leaves raising taxes. Nobody wants to do this while we're in the middle of a soft economy, but somebody's got to come up with something. I wouldn't mind paying higher taxes if I knew that it was in the national interest, and there are lots of ways to do it. One is to revert to an older tax rate system; another is to impose the old estate tax system.

I recommend returning to former taxation systems such as the one that was in place when Nixon was president. Nixon is probably the last guy you would ever consider "liberal." No one would ever call Nixon a "tax and spender." Yet the highest marginal tax rate when he was president was 70%.[Source]

As for the estate tax, the pre-Bush rates were 55% taxes over $1 million. In the compromise plan, it was changed to 35% over $5 million, which I think is way too lenient -- one number or the other has got to change. Either make it 55% over $5 million or 35% over $1 million.

I know pundits complain about this "death tax" and how it contradicts the "American Dream" of passing something on to your family, but seriously -- who do you thing needs to pay more taxes? The poor? Of course not. The middle class? No, they drive the economy. The rich? No, supply siders say they help grow the economy.

So who should pay more taxes? Me personally, I can't think of anyone I'd rather tax than dead millionaires. They'd lived their lives, they've enjoyed their wealth, and they've moved on. "You can't take it with you," as the saying goes, and the nation doesn't need a bunch of idle millionaire kids running around.

Besides, we could certainly use it down (up?) here. And what's the worst they can do? Vote you out of office? (Well, maybe in Chicago...) Even in bad years, incumbents have very little to fear from challengers. [Source]

Merriam-Webster named "austerity" the Word of the Year for 2010 [Source], which I think is entirely appropriate. Better yet -- make it the word of the decade, because we're going to need it for a lot longer than a year.

Merriam-Webster named "austerity" the Word of the Year for 2010 [Source], which I think is entirely appropriate. Better yet -- make it the word of the decade, because we're going to need it for a lot longer than a year.

No comments:

Post a Comment