I did not think it would go like this.

Source

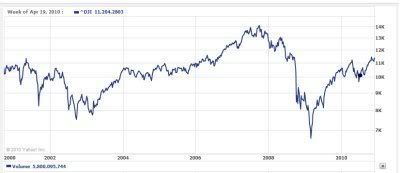

I was working out the math, and it turns out that I've averaged about a 1% annual return for the past ten years. Having been rocked by a series of negative event -- the last bit of the dot-com bubble, the 2003 invasion, and the mortgage crisis -- it's like my savings have been the main star in some sadistic, twisted Sisyphean drama. I make some gains in the booms, only to lose them in the next bust. It's just like the 1970s.

Plus, inflation's been eating away at my money the whole time. From October 2000 to October 2010, inflation's been about 2.1% annually [Source]. So while I may not have lost money, per se, it can't buy as much as it used to.

A couple good things, though -- inflation's not at all as bad now as it was in the 70s, and at the very least never had to take a job with Enron.

No comments:

Post a Comment